The Talent Trap: Why Europe’s Best Minds Aren’t Founding Tech Giants

Europe’s Talent Is World-Class—So Why Isn’t Its Tech?

Europe is home to some of the best universities, brightest minds, and most well-educated engineers in the world. By all logic, it should be a global leader in tech. And yet, it’s not.

Europe Has A Brilliant Educational System

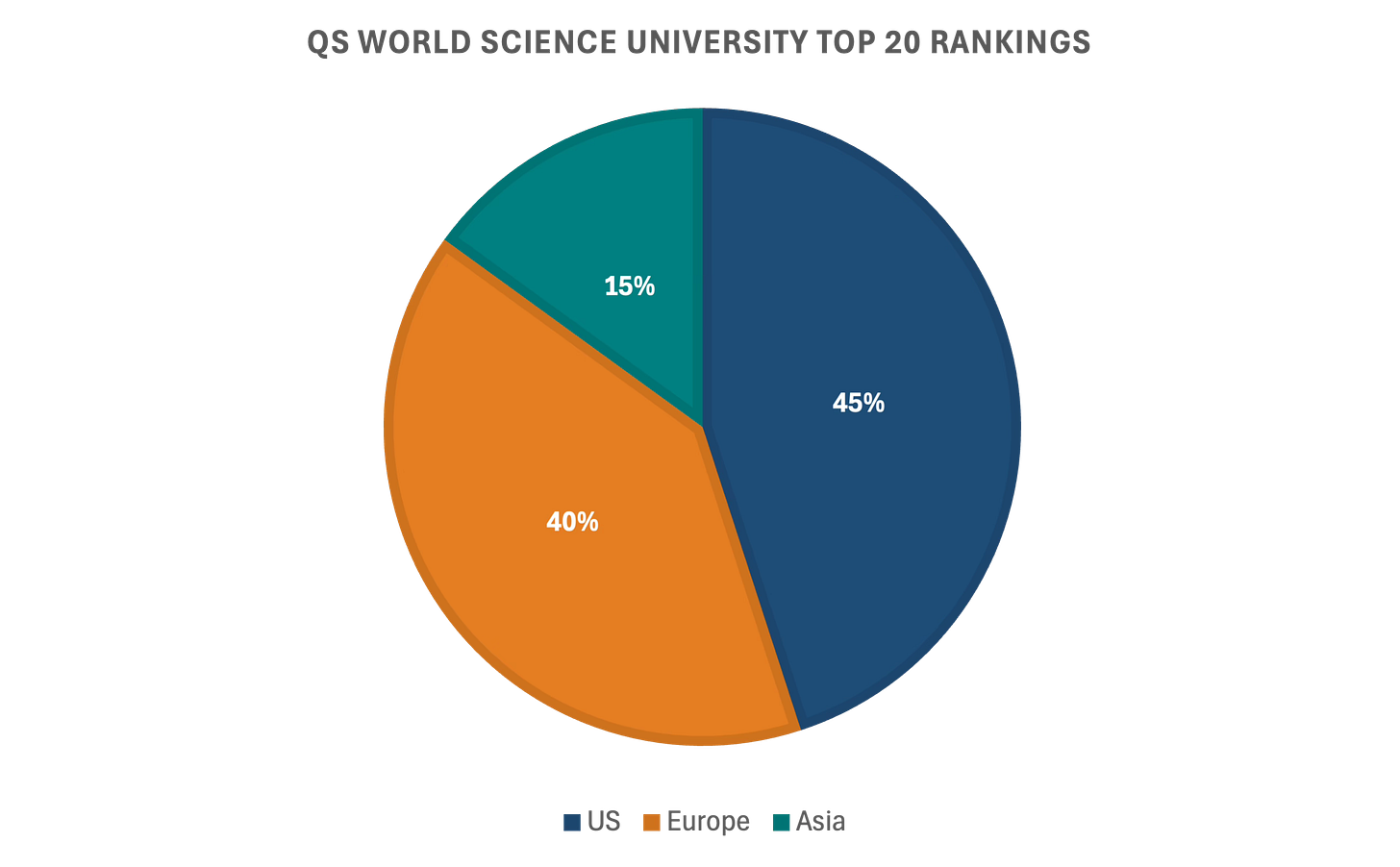

Europe has the brains and the talent, and the numbers back it up. When it comes to STEM universities, Europe has just as many in the global top 20 as the U.S. By that logic, Europe is producing as many world-class engineers, researchers, and technologists.

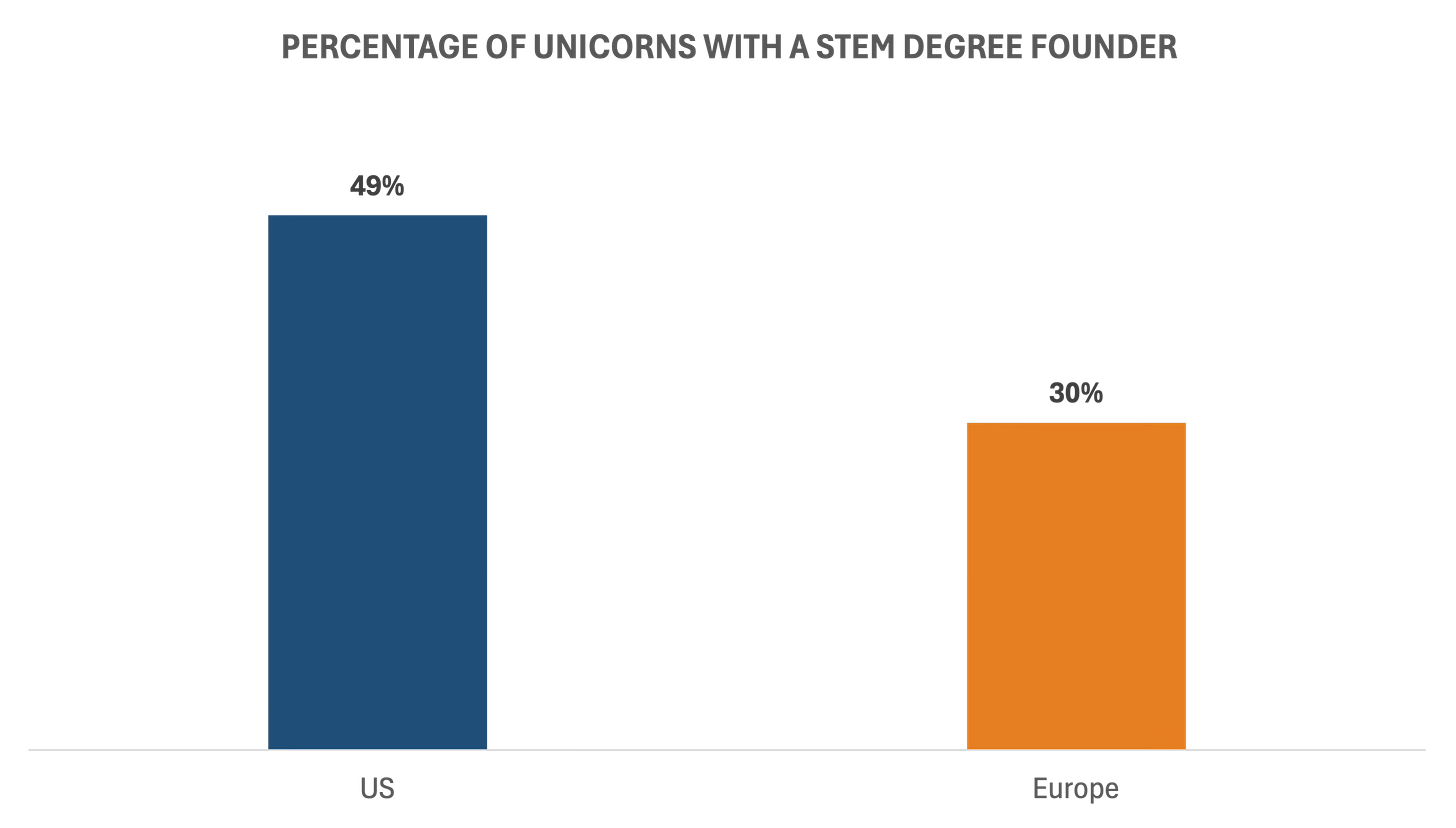

And yet, Europe struggles to translate its academic strength into entrepreneurial success. In the U.S., 49% of unicorns have a STEM-educated CEO or founder. In Europe, that figure drops to just 30%—almost two-thirds less. But why? The talent is just as sharp and always cheaper to hire.

The European Risk-Averse Mindset

Europe has the capability but lacks the mindset. From a young age, Europeans are taught to prioritise stability. Get a good job. Follow a safe career path. Don’t take unnecessary risks.

In the U.S., failure—whether at a startup or in a career move—is celebrated as a learning experience. In Europe, it’s seen as a mistake. Both regions have opportunities but importantly the U.S. has the proof points that taking a swing at something unproven is worth the risk.

Take two graduates in 2017—one joining an investment bank and the other taking a job at a little-known defence tech startup. Fast forward to today, and there’s a good chance that early employees at Anduril are now all millionaires.

The narrative is budding in Europe. We’re only just seeing the first significant tech success stories—Revolut, UiPath, and Klarna. These are companies that Europe hopes to see produce their own ‘mafias’ of ex-founders and early employees who go on to build more startups, much like PayPal did in the U.S.

What Europe Has Going for It

It’s not all bad. Europe has structural advantages that will never change. The time zone is perfect, speaking to Asia in the morning, the Middle East and the U.S. in the evening. English is the dominant business language. The food, culture, and quality of life are objectively better than in many U.S. cities. And Europe’s version of capitalism, while still competitive, avoids some of the extreme wealth gaps the U.S. has created.

Europe has excelled in building focused solutions in key sectors, such as FinTech, by leveraging foundational technologies in smart ways. Few would question whether the neo-banking and financial tech advancements produced in Europe have been matched elsewhere.

But despite this, Europe still doesn’t provide the right platform for its talent.

Regulate. Regulate. Regulate

Europe regulates too much. Instead of innovating first and figuring things out later, the region hesitates. It wants everything to be understood, studied, and controlled before its best mind’s can try.

This hesitation has cost Europe before. It missed the PC revolution, lagged behind in software, and failed to dominate the internet wave. The same thing is happening now with AI. Europe led the world in creating GDPR, and it’s doing the same with the AI Act. It’s regulation before innovation. It was only two months ago this was a UK headline:

“Prime Minister Sir Keir Starmer, the chancellor, and business secretary have written to the UK's main regulators asking them to come up with ideas that could boost economic growth.”

The fact that government leaders are asking regulators where innovation should come from shows how deep the problem runs.

An Opportunity to Swerve or Buy?

If Europe shifted its mindset—encouraging and supporting risk-taking, celebrating failure, and reducing regulatory friction—it could look very different. Here’s the real kicker: there could be alpha to be made at entry.

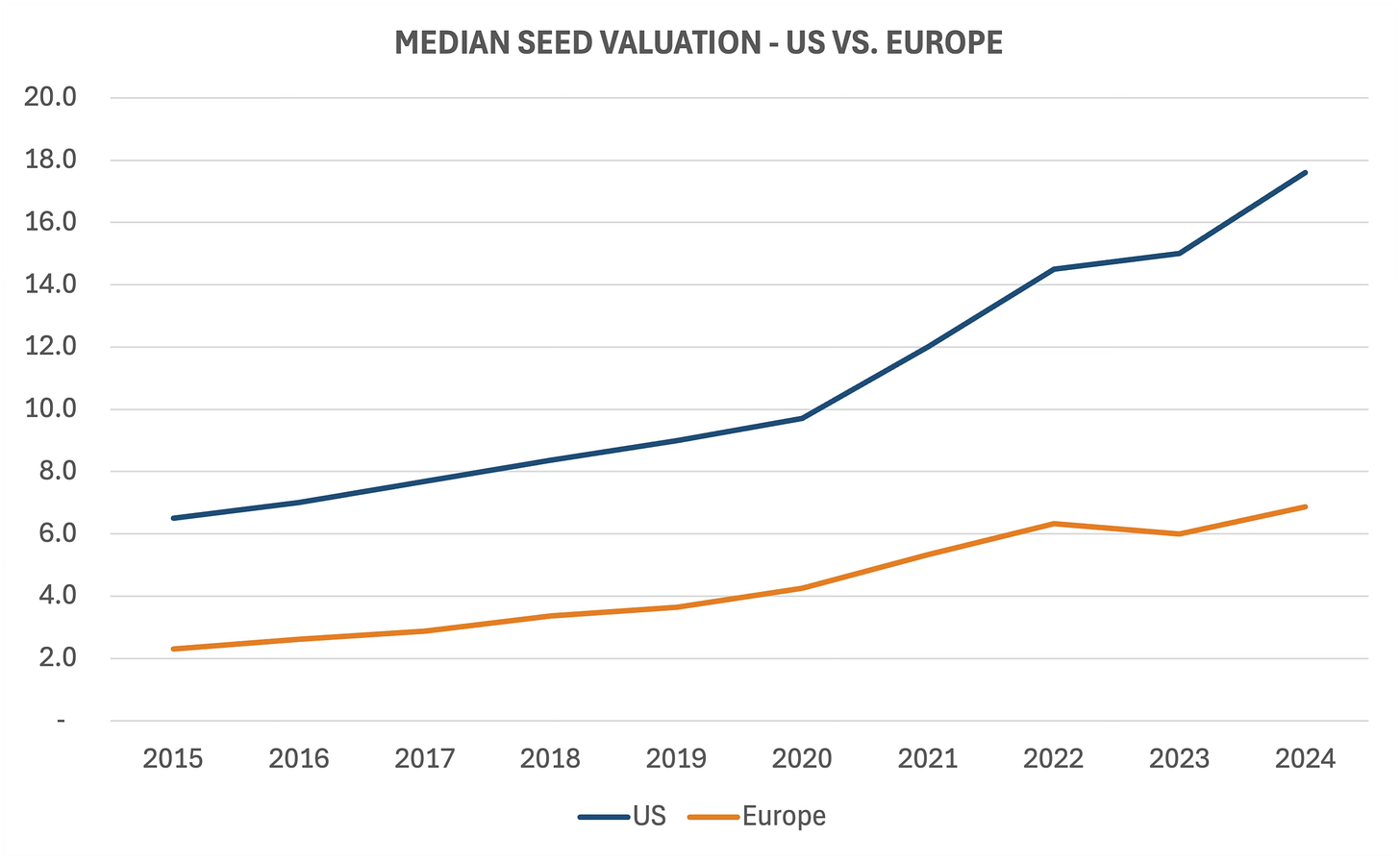

At the seed stage, median valuations are 150% lower than in the U.S. If you believe that the system can evolve and that Europe’s mindset can shift with support, then right now could be a generational buying opportunity.

The flip side? The market has priced in Europe’s stagnation. Investing in European startups today means betting that the region can fix its structural issues—and right now, that’s a tough sell.

Europe Is a Sleeping Giant

Europe has the talent, the education, and even the proof points of success. What it lacks is the ecosystem to translate these advantages into a thriving, world-beating startup scene. The risk-averse mindset, regulatory hurdles, and fragmented funding landscape hold Europe back from the next golden era of entrepreneurship.

The good news? Change is possible. The rise of unicorns like Revolut, UiPath, and Klarna suggests that Europe is finally building the kind of companies that can create second and third-generation founders. The next step is supporting a culture where risk-taking is rewarded, failure is a stepping stone, and regulation enables rather than restricts innovation.

For investors, this is a challenge and an opportunity. Are European startups undervalued compared to their U.S. peers? If the structural problems can be addressed—even marginally—early backers of Europe’s next wave could see outsized returns.

This is the bet for allocators: Can Europe shift its mindset in time? Or will it keep watching its best talent either stay on the sidelines or leave for markets that reward ambition? The answer will determine whether Europe remains a sleeping giant—or finally wakes up.