Backing Micro VCs

Sub-$5M and Supercharged

In venture, smallness is often equated with lack; lack of capital, lack of scale. But in our experience, small can also mean the opposite. It can mean agile. It can mean focused. And when deployed with discipline, small can mean outperforming. When you back the right people at the right stage, small — however counterintuitive — can mean large.

That’s why we’ve created a dedicated sleeve to back a specific kind of investor: $10-20M micro VCs with asymmetric potential. These are GPs who are playing to their strengths, staying early, and building concentrated portfolios at fund sizes where real venture returns are possible. Whatever the state of the world, new businesses will be created. This is how we will back them from the very beginning.

The Two Types of GP That Matter

Two types of GPs tend to fall into this camp. The first are founders-turned-investors. They know what it takes to build, are deeply plugged into early ecosystems, and often have access to deals before traditional venture firms. GPs benefit from understanding and affinity; founders want other founders on the cap table, not just for optics, but for helping solve problems only operators can solve. These GPs come with first-time investor risk, but their sourcing advantage is real, and at the earliest stage, that’s often the edge.

The second are spinouts. These investors, trained at top-tier funds, are taking pattern recognition muscles and applying them at a scale where the math works. They’ve seen what great looks like and what bloated looks like; often, in fact, these aren’t opposites but stages on a continuum. They want —and crucially know how— to invest, however, in their own way now, with faster decisions, and fund sizes that don’t require chasing logos to justify ownership. Here, one underwrites deal flow risk; the risk that person A loses relevance without a shiny logo next to their name.

Different backgrounds; different strengths. The common denominator, however, is their potential to outperform.

The Why, The What, The How

We created this sleeve because we want to back managers investing at the point where the risk is real but the price is right. This is not “spray and pray”— if anything, the inverse logic drives these funds. These structures are designed to exploit strategic advantages that only appear at the earliest stage, often at sub-$5M valuations; attractive entry points where common venture exits (<$200M) still mean something. Where one breakout can return the fund, and the power law is less myth and more math.

What we’re underwriting is a clarity of mandate. These GPs write $100K to $500K initial checks. They do not obsess about ownership targets. Their strategy is to build a portfolio of companies and not hold back for follow-ons. This allows them to move quickly and participate in syndicates without having to rely on leading a round. This isn’t about governance—it’s about access. They are investing like angels but with the budget and discipline of a fund.

It’s a structure that works for founders—they get cleaner caps, faster closes, and less noise. It works for LPs, who gain exposure to asymmetric outcomes without overpaying for entry. Not only that, it fits the macro. Seed is consolidating, and multi-stage firms continue to lead large early-stage rounds with high entry prices. Managers partaking in these rounds are underwriting late-stage risk without late-stage protections. Our conviction is simple: get in earlier, stay lighter, and back the people who know how to operate in that ambiguity.

For Every Decacorn, There Are 20 Unicorns

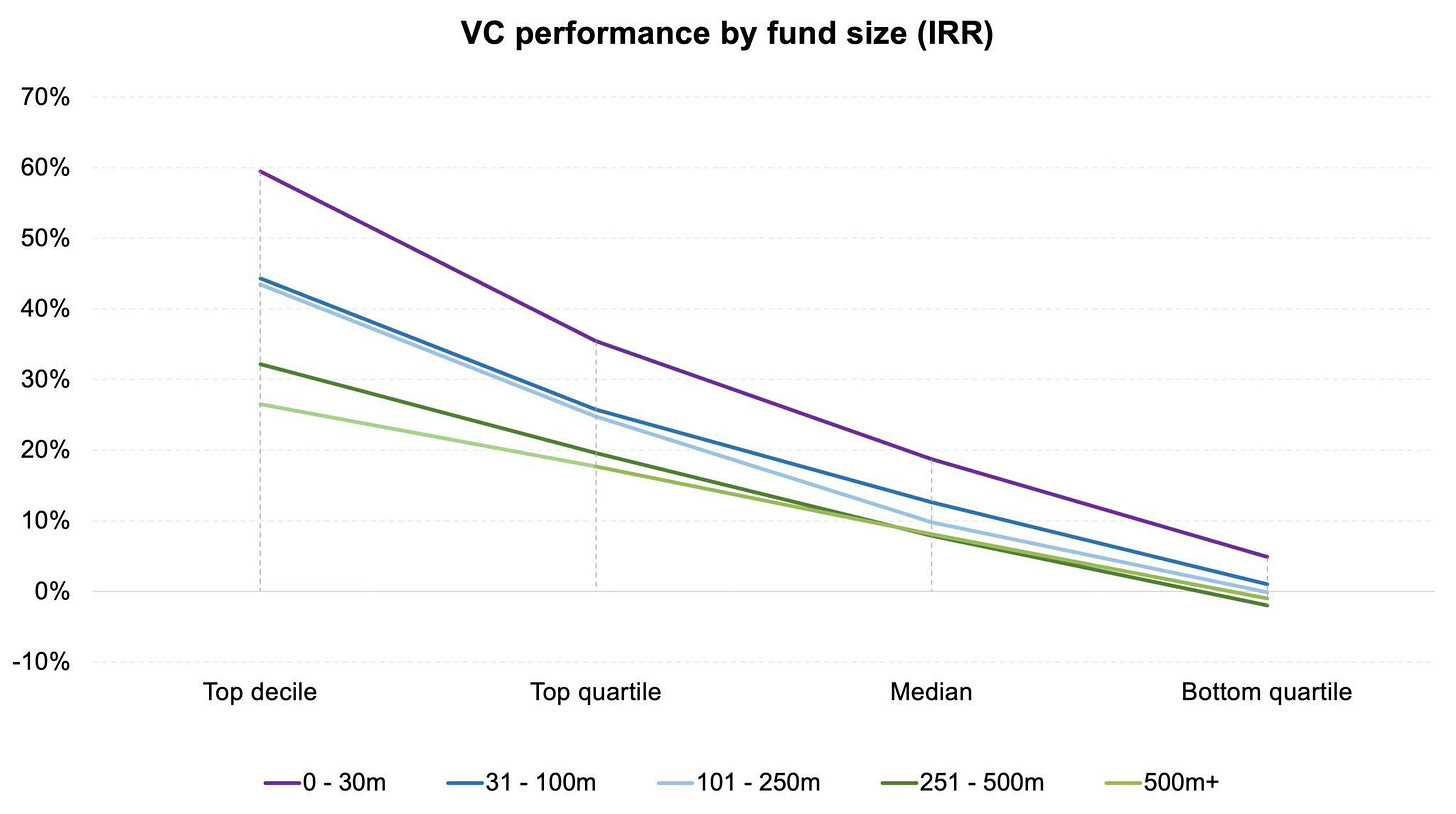

The data backs it up. Micro VCs, especially those deployed at the early stage, consistently outperform on an IRR basis. Using PitchBook’s data, the smaller the fund, the better the performance.

This is far from anecdotal; this is real performance. It’s also basic maths: smaller funds don’t need $10B outcomes. What they need is to get one thing pretty right. To put all of this into perspective: a $1B exit for a $20M fund, with 2% ownership, returns 1.0x DPI. And remember: for every decacorn, there are over 20 unicorns. Give yourself a higher likelihood of getting in fund-returning investments.

This is not a sleeve to follow a trend or a hype. We created it because we believe in the people who are building focused strategies, at the earliest stages, and because we truly believe this structure gives a real shot at outsized outcomes. In the hands of the right GPs, micro funds with sharp mandates can drive real returns — not just hypothetically—historically, which is precisely why we’re backing micro VCs. They may be small, but precedence and math are on their side.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e

Love it! Completely agree with the thesis. We need more of these.